Explain the Different Types of Cost Concepts

DOB is the stored attribute. Even if your output changes or you dont produce anything your fixed costs stay the same.

Costs can be classified in different ways.

. These are all those expense item appearing in the books of account hence based on accounting cost. Costs may also be classified according to the time element in it. The cost concepts are.

There are various types of cost. A list and definition of different types of economic costs. Outlay costs include the actual expenditure of funds on factors like material rent wages etc.

Variable cost varies with output and is zero at zero output level. A fixed cost such as rent does not change in lock step with the level of activity. Historical Costs are those costs which are taken into consideration after they have been incurred.

Period costs - are not inventoriable and are charged against revenue immediately. Total Fixed Costs TFC. These costs do not vary with the change in volume of production.

30 for every level of output. Distinguish between product costs and period costs and give examples of each. Conversely a variable cost such as direct materials will.

It is used for analyzing the cost of a project in short and long run. The following points highlight the top nine cost concepts used in decision making. Direct costs are those cost that have directly accountable to specific cost object such as a process or product Exwages paid salary paid labor materialetc Indirect cost.

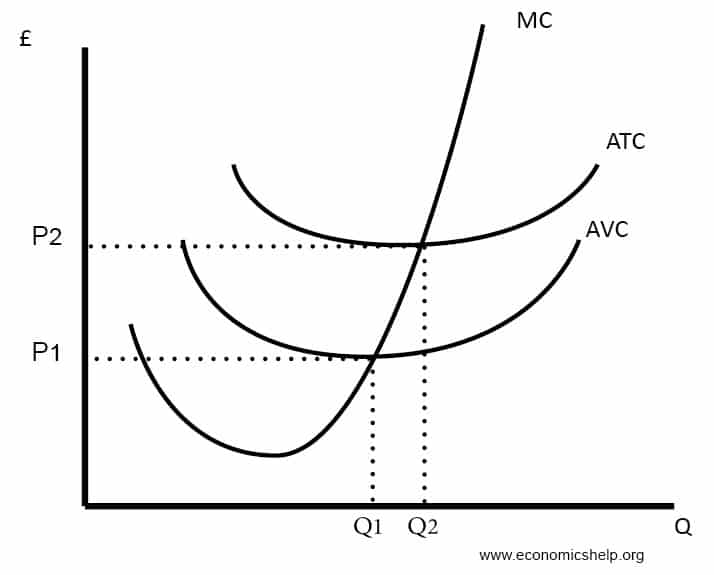

Outlay cost concepts are actual expenditures and the books of accounts record them. Total fixed costs TFC Average fixed costs AFC Total variable costs TVC Average variable cost AVC Total cost TC Average total cost ATC Marginal cost MC 4. Consequently when reviewing a business case to determine which path to take it is useful to understand the following cost concepts.

When one attribute value is derived from the other is called a derived attribute. Accordingly costs are classified into. Opportunity costs and Outlay costs.

Direct costs are related to producing a good or service. Indirect costs on the other hand are expenses unrelated to producing a good or service. Variable Cost It is the cost of variable inputs used in production.

Indirect cost are those costs which are not directly accountable to specific cost object or not directly related to production Ex. Refer to the costs that remain fixed in the short period. Out of Pocket Costs 3.

There are manufacturing costs and non-manufacturing costs direct and indirect costs product and period costs controllable and uncontrollable costs fixed and variable etc. Management accountants need to understand cost concepts because they are vital in many areas of planning control and decision-making. The above table shows different types of cost concept.

Fixed cost is fixed at Rs. Marginal cost is the cost of producing an additional unit of output while incremental cost is defined as the change in cost resulting from a change in business activities. After Studying this chapter you should be able to.

A direct cost includes raw materials labor and. 1 Types of Costs. In other words it compares the policy chosen and policy rejected.

Derived Attributes or stored Attributes. Past Cost and Future Costs 4. On the other hand opportunity costs are the costs of missed opportunities.

These costs vary with the change in volume of production. Identify and give examples of each of the three basic manufacturing cost categories. Outlay and Opportunity Costs.

Incremental Costs and Sunk Costs 3. Classification of Cost Types of Cost. These costs do not change with.

Relevant Cost and Irrelevant Cost. Cost of sales only when sold. The various relevant concepts of cost are.

Actual Cost and Opportunity Cost 2. In other words incremental cost is the total additional cost related to marginal quantity of output. Marginal cost is the rate of change of total cost.

Fixed Cost Variable Cost Average Cost and Marginal Cost Opportunity Cost The resources of any firm operating in the market are limited and investment options are many. What Are the Types of Costs in Cost Accounting. Fixed Costs FC The costs which dont vary with changing outputFixed costs might include the cost of building a factory insurance and legal bills.

Avoidable Cost and Unavoidable Cost 9. Different types of costs have differing characteristics. Out lay cost also known as actual costs are those expends which are actually incurred by the firm these are the payments made for labour material plant building machinery traveling transporting etc.

Short Run Cost and Its Types With Diagram i. Fixed and Variable Costs 6. Prepare an income statement including calculation of the cost of goods sold.

Total Variable Costs TVC. Age can be derived from date of birth where Age is the derived attribute. Total cost is the summation of both fixed and variable costs.

All manufacturing costs direct materials direct labor and factory overhead are product costs. Cost Concept 1. Short-Run and Long-Run Costs 5.

2 Infographic of Types of Costs. The kind of cost concept to be used in a particular situation depends upon the business decisions to be made. Period costs include non-manufacturing costs ie.

Fixed Variable and Mixed Costs. Product costs - are inventoriable costs. Refer to costs that change with the change in the level of production.

On the basis of Nature of Costs Fixed Cost It is the cost of fixed inputs used in production. Cost Concepts 1. Cost Terms Concepts and Classifications.

They form part of inventory and are charged against revenue ie. And ii Predetermined Costs.

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Co Cost Sheet Project Management Tools Accounting And Finance

This Ppt Consists Information About Cost Analysis And Cost Concepts And Short Run And Long Run Cost Function Managerial Economics How To Run Longer Ppt

What Are The Different Types Of Business Process Outsourcing In 2022 Business Process Outsourcing Outsourcing Business

Cost Behavior Meaning Importance Types And More Bookkeeping Business Accounting Education Financial Management

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Costing In 2022 Cost Sheet Accounting And Finance Cost Control

Concepts Of Cost Revenue Class 11 Cbse Class 12 Economics Pdf Economics Notes Economics Basic Concepts

Accounting Concepts Accounting Accounting Principles Learn Accounting

10 Types Of Costs In Economics Economics Economics Lessons Writing Services

Cost Based Pricing Meaning Types Advantages And More Bookkeeping Business Business Basics Learn Accounting

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Cash Budget

Pin By Hannah Bear On 1 0 Infographics Managerial Accounting Cost Accounting Variables

Types Of Costs And Their Basis Of Classification Accounting Education Cost Accounting Bookkeeping Business

Cost Sheet Cost Accounting Accounting Basics

How Much Does It Cost To Make A Video Infographic Video Marketing Video Content Marketing Infographic Marketing

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Costing Cost Sheet Managerial Accounting Cost

Comments

Post a Comment